| Module | Module Name | Links | Links | Blake's Links |

| PM | Plant Mantenance | tutorials point | Blake | |

| MM | Material Management | tutorials point Overview | Guru99 | Blake: 1-10 | 11-20 | 21-25 |

| SD | Sales and Distribution | tutorials point Tutorial | Guru99 | Blake |

| PP | Production Planning | tutorials point Tutorial | Guru99 | Blake | 1-7 |

| External Links | ||||

| NewLanguage.html | FICO Module: Blake's 1-28 29-56 57-66 67-83 : Tutorials Point | |||

| Download Info | ABAP Module: Blake's 1-18 19-36 37-52 : Tutorials Point | |||

| 1 | Home | FICO_Doc Tutorials Point | 29 | Block a Customer | FICO_Doc Tutorials Point | 57 | Month End Closing | FICO_Doc Tutorials Point | ||

| 2 | Overview | FICO_Doc Tutorials Point | 30 | Delete a Customer | FICO_Doc Tutorials Point | 58 | Dunning | FICO_Doc Tutorials Point | ||

| 3 | Submodules | FICO_Doc Tutorials Point | 31 | Customer Account Group | FICO_Doc Tutorials Point | 59 | Exchange Rates | FICO_Doc Tutorials Point | ||

| 4 | Company Basics | FICO_Doc Tutorials Point | 32 | One-Time Customer Master | FICO_Doc Tutorials Point | 60 | Tables in Module | FICO_Doc Tutorials Point | ||

| 5 | Define Business Area | FICO_Doc Tutorials Point | 33 | Post a Sales Invoice | FICO_Doc Tutorials Point | 61 | AR Invoice Processes | FICO_Doc Tutorials Point | ||

| 6 | Define Functional Area | FICO_Doc Tutorials Point | 34 | Document Reversal | FICO_Doc Tutorials Point | 62 | AR Account Analysis | FICO_Doc Tutorials Point | ||

| 7 | Define Credit Control | FICO_Doc Tutorials Point | 35 | Sales Returns | FICO_Doc Tutorials Point | 63 | AR Reporting | FICO_Doc Tutorials Point | ||

| 8 | General Ledger | FICO_Doc Tutorials Point | 36 | Post Incoming Payment | FICO_Doc Tutorials Point | 64 | AA Overview | FICO_Doc Tutorials Point | ||

| 9 | COA Group (Chart of Accts) | FICO_Doc Tutorials Point | 37 | Foreign Currency Invoice | FICO_Doc Tutorials Point | 65 | AA Asset Explorer | FICO_Doc Tutorials Point | ||

| 10 | Retained Earnings Account | FICO_Doc Tutorials Point | 38 | Incoming Partial Payments | FICO_Doc Tutorials Point | 66 | Cash Management | FICO_Doc Tutorials Point | ||

| 11 | G/L Account | FICO_Doc Tutorials Point | 39 | Reset AR Cleared Items | FICO_Doc Tutorials Point | |||||

| 12 | Block G/L Account | FICO_Doc Tutorials Point | 40 | Credit Control | FICO_Doc Tutorials Point | 67 | CO Overview | FICO_Doc Tutorials Point | ||

| 13 | Deleting G/L Accounts | FICO_Doc Tutorials Point | 41 | Accounts Payable | FICO_Doc Tutorials Point | 68 | CO Submodules | FICO_Doc Tutorials Point | ||

| 14 | Financial Statement Version | FICO_Doc Tutorials Point | 42 | Create a Vendor | FICO_Doc Tutorials Point | 69 | CO Cost Center | FICO_Doc Tutorials Point | ||

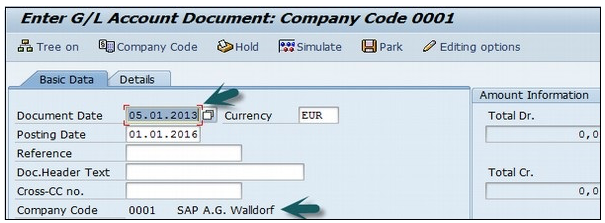

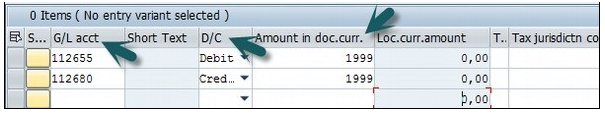

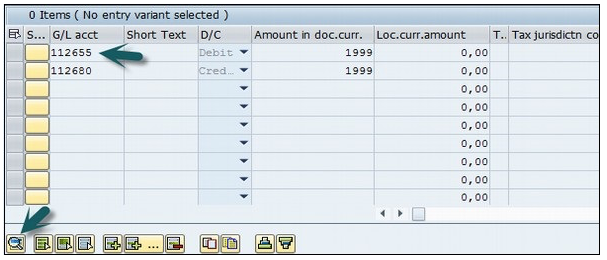

| 15 | Journal Entry Posting | FICO_Doc Tutorials Point | 43 | Create Vendor Account Group | FICO_Doc Tutorials Point | 70 | CO Create Cost Center | FICO_Doc Tutorials Point | ||

| 16 | Fiscal Year Variant | FICO_Doc Tutorials Point | 44 | Display Changed Fields | FICO_Doc Tutorials Point | 71 | CO Post to a Cost Center | FICO_Doc Tutorials Point | ||

| 17 | Posting Period Variant | FICO_Doc Tutorials Point | 45 | Block a Vendor | FICO_Doc Tutorials Point | 72 | CO Internal Orders | FICO_Doc Tutorials Point | ||

| 18 | Field Status Variant | FICO_Doc Tutorials Point | 46 | Delete a Vendor | FICO_Doc Tutorials Point | 73 | CO Settlement of IO | FICO_Doc Tutorials Point | ||

| 19 | Field Status Group | FICO_Doc Tutorials Point | 47 | One-Time Vendor | FICO_Doc Tutorials Point | 74 | CO Profit Center | FICO_Doc Tutorials Point | ||

| 20 | Define Posting Keys | FICO_Doc Tutorials Point | 48 | Post Purchase Invoice | FICO_Doc Tutorials Point | 75 | CO Posting to Profit Center | FICO_Doc Tutorials Point | ||

| 21 | Define Document Type | FICO_Doc Tutorials Point | 49 | Purchase Returns | FICO_Doc Tutorials Point | 76 | CO Profit Center Standard Heirarchy | FICO_Doc Tutorials Point | ||

| 22 | Document Number Ranges | FICO_Doc Tutorials Point | 50 | Post Outgoing Vendor Payment | FICO_Doc Tutorials Point | 77 | CO Assigning Cost to Profit Centers | FICO_Doc Tutorials Point | ||

| 23 | Post with Reference | FICO_Doc Tutorials Point | 51 | Foreign Currency Invoice | FICO_Doc Tutorials Point | 78 | CO Assigning Materials to Profit Centers | FICO_Doc Tutorials Point | ||

| 24 | Hold a G/L Document Posting | FICO_Doc Tutorials Point | 52 | Withholding Tax in vendor invoice | FICO_Doc Tutorials Point | 79 | CO Tables in Module | FICO_Doc Tutorials Point | ||

| 25 | Park a G/L Document Posting | FICO_Doc Tutorials Point | 53 | Outgoing Partial Payments | FICO_Doc Tutorials Point | 80 | CO Product Costing | FICO_Doc Tutorials Point | ||

| 26 | G/L Reporting | FICO_Doc Tutorials Point | 54 | Reset AP Cleared Items | FICO_Doc Tutorials Point | 81 | CO Profitability Analysis | FICO_Doc Tutorials Point | ||

| 27 | Accounts Receivable | FICO_Doc Tutorials Point | 55 | Automatic Payment Run | FICO_Doc Tutorials Point | 82 | CO Planning Methods | FICO_Doc Tutorials Point | ||

| 28 | Customer Master Data | FICO_Doc Tutorials Point | 56 | Posting Rounding Differences | FICO_Doc Tutorials Point | 83 | FI - Integration | FICO_Doc Tutorials Point | ||

SAP CO includes managing and configuring master data that covers cost and profit centers, internal orders, and other cost elements and functional areas.

The main purpose of SAP controlling module is planning. It enables you to determine variances by comparing actual data with plan data and thus enables you to control business flows in your organization.

Both SAP CO and SAP FI modules are independent components in a SAP system. The data flow between these components takes place on a regular basis.

Data flows relevant to cost flows to Controlling from Financial Accounting.

At the same time, the system assigns the costs and revenues to different CO account assignment objects, such as cost centers, business processes, projects or orders.

The key submodules of SAP controlling system are listed below −

Cost Element Accounting − Cost and Revenue Element Accounting provides you with an overview of the costs and revenues that occur in an organization.

Most of the values are moved automatically from Financial Accounting to Controlling.

Cost and Revenue Element Accounting only calculates costs which either do not have another expense or only one expense in Financial Accounting.

Cost Center Accounting − Cost Center Accounting is used for controlling purposes within your organization.

Activity-Based-Accounting − It is used to analyze cross-departmental business processes.

Internal Orders − Internal orders in SAP CO are used to collect and control according to the job that incurred them.

You can assign budgets for these jobs that is system monitored to ensure that they are not exceeded from the set budgets.

Product Cost Controlling − It calculates the cost for manufacture a product, or to provide a service. It allows you to calculate the price at which you can profitably marketed it.

Profitability Analysis − It is used to analyze the profit or loss of an organization by individual market segments.

Profitability Analysis provides a basis for decisionmaking.

For example, it is used to determine price, conditioning, customer, distribution channel, and market segment.

Profit Center Accounting − It is used to evaluate profit or loss of individual, independent areas within an organization. These areas are responsible for their costs and revenues.

A Cost Center is defined as a component in an organization that adds to the cost and indirectly adds to the profit of the organization. Examples include Marketing and Customer Service.

A company can classify a business unit in three ways −

The simple and straightforward division in an organization can be classified as cost center because cost is easy to measure.

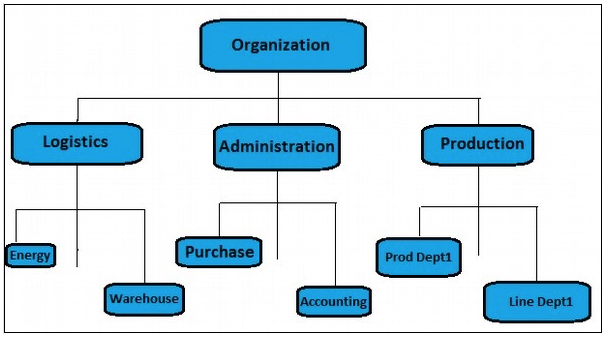

The hierarchy of a cost center looks as follows −

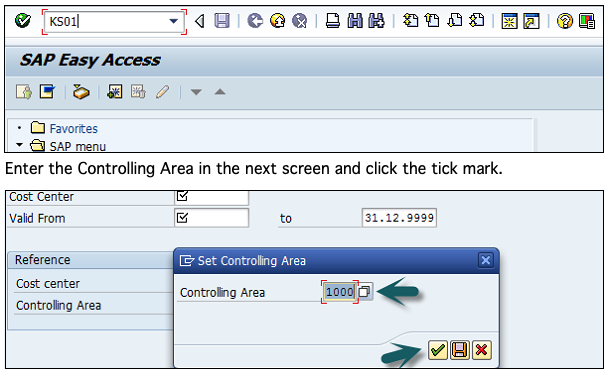

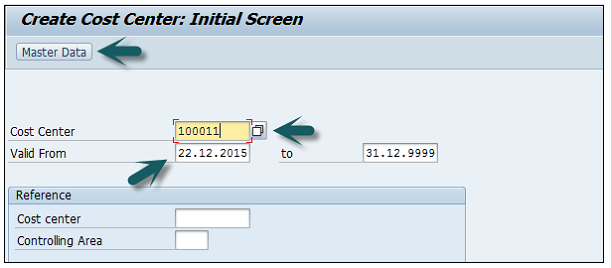

In the next window, enter the following details and click the Master Data.

You can also create a new cost center with a reference.

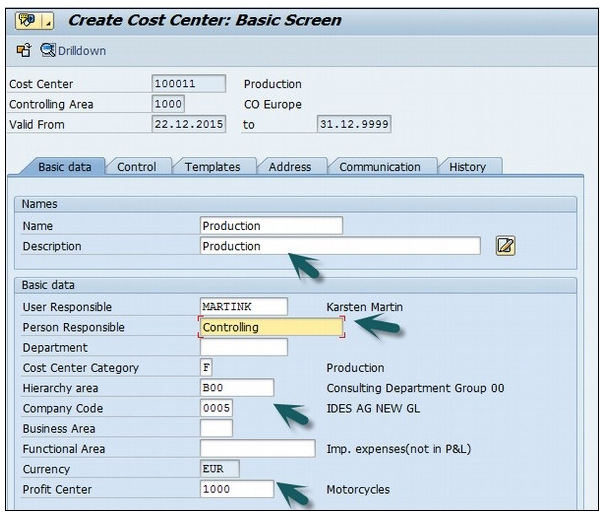

Once you click Master Data, a new window will open. Enter the following details in the basic data tab −

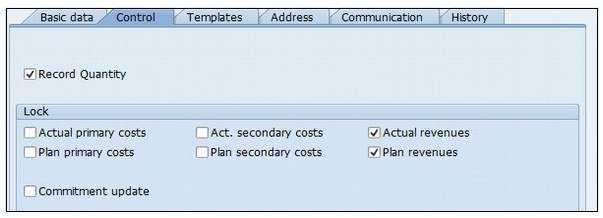

Next, click the Control tab and select the correct indicator.

At the end, click the save icon at the top.

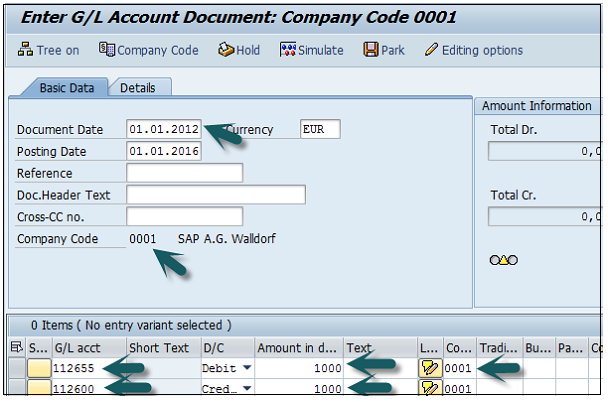

In this window, you need to enter the following details −

Click the Save button at the top to post to this cost center.

You can create an internal order to monitor the costs of a time-restricted job or the costs for the production of activities. Internal orders can also be used for the long-term monitoring of costs.

Investment cost related to fixed assets are monitored using Investment orders.

Period-related accrual calculation between expenses in FI and the costing-based costs debited in Cost Accounting are monitored using Accrual orders.

Costs and revenues incurred for activities for external partners or for internal activities that do not form a part of the core business for your organization are monitored using order with revenues.

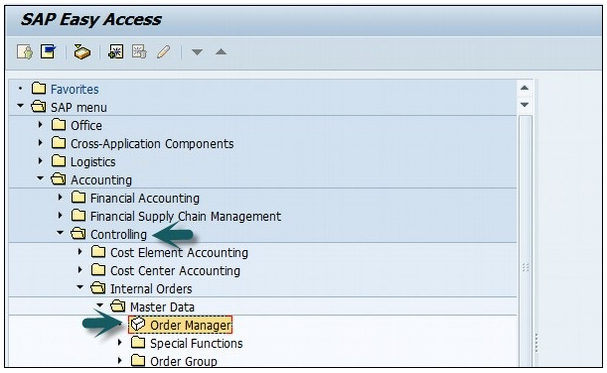

Use the T-code KO04 or go to Accounting → Controlling → Internal Orders → Master Data → Order Manager.

In the next screen, input the controlling area as shown below −

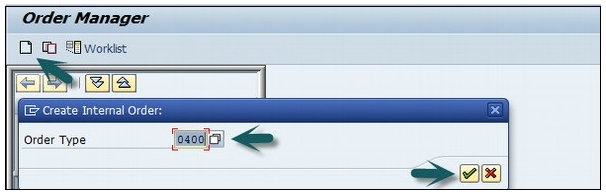

Click the Create button at the top to create a new internal order and enter the order type.

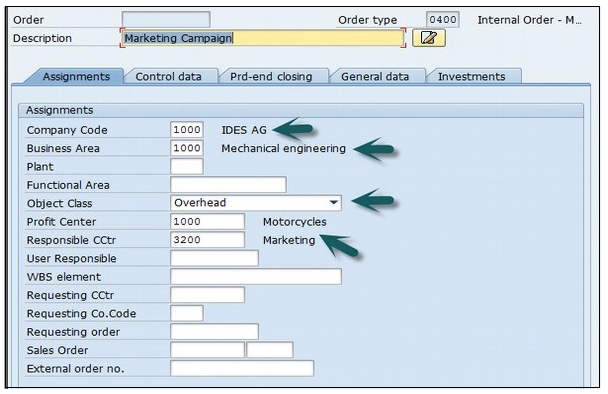

In the next window, enter the following details −

After entering the above details, click the Save button at the top to create the internal order.

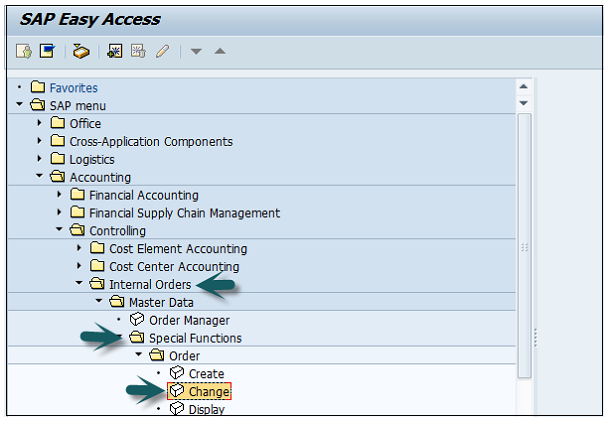

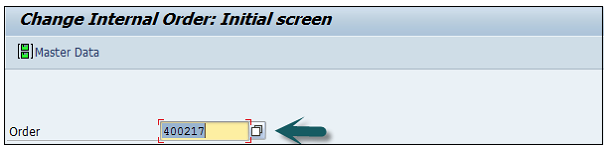

Use the T-code − KO02 or Go to Accounting → Controlling → Internal Orders → Master Data → Special Functions → Change.

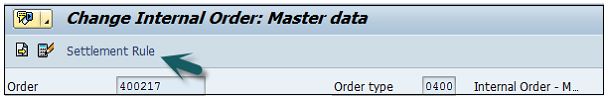

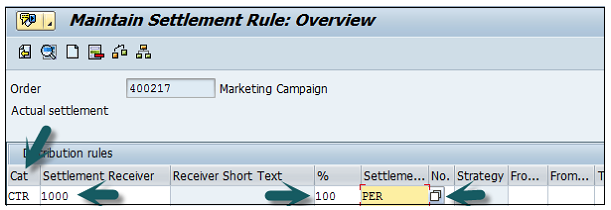

Click the Settlement rule button at the top −

Enter the following details −

Click the save button at the top to save the settlement rule and come back to the main screen.

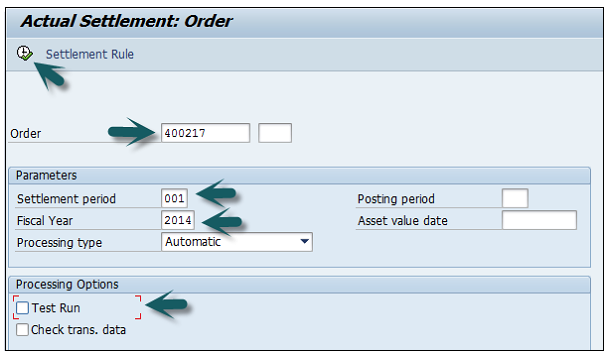

Enter the T-code KO88 and input the following details −

Profit Center is a part of Enterprise Controlling module and is integrated with a new General Ledger Accounting.

Profit Center Accounting is used to determine profit for internal areas of responsibility. It lets you determine profits and losses using either period accounting or the cost-of-sales approach.

It allows you to analyze fixed assets by profit center, thus using them as investment centers. It allows to expand profit centers to investment centers.

The main aim of creating a Profit Center in SAP CO is to analyze the cost of a product line or a business unit.

You can also generate P&L accounts according to a Profit Center and also generate balance sheets, however a Profit Center should only be used for internal reporting purpose.

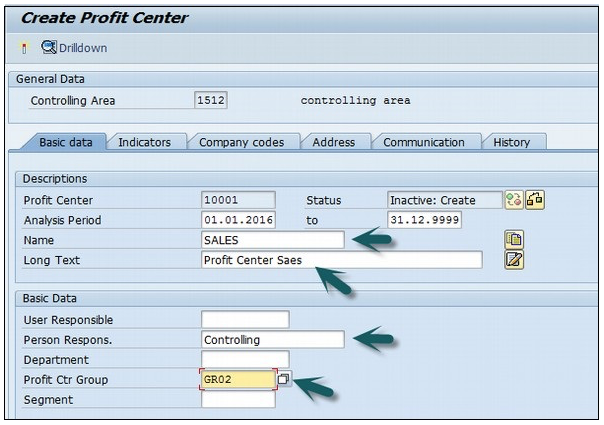

The key components of a profit center include – name of the profit center, the controlling area under which it is assigned, time period, person responsible for the profit center, standard hierarchy, etc.

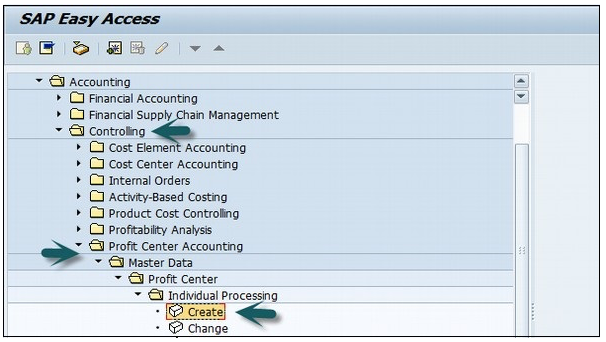

Use the T-code KE51 or go to Accounting → Controlling → Profit Center Accounting → Master Data → Profit Center → Individual Processing → Create.

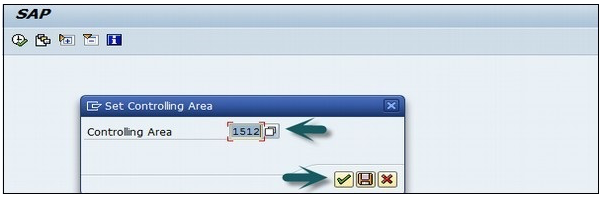

In the next screen, enter the controlling area in which the profit center is to be created and click the tick mark.

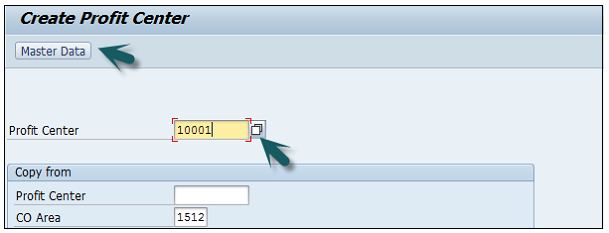

In the next screen, enter the unique profit center ID and click Master Data.

A new window will open where you need to input the following details −

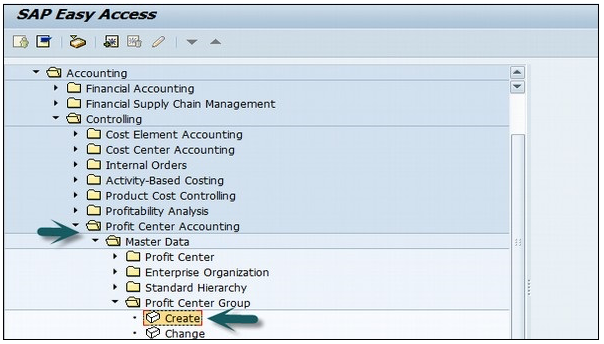

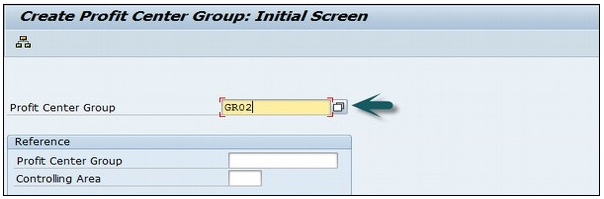

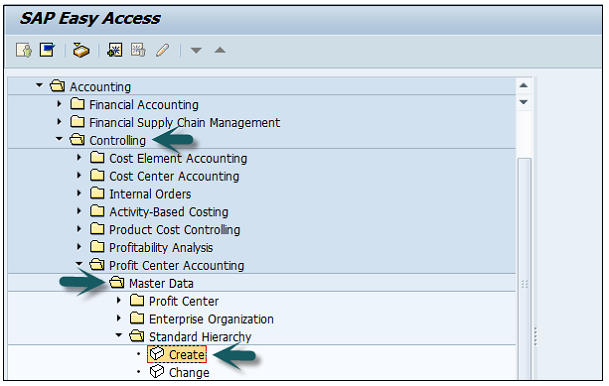

Use the T-code KCH1 or go to Accounting → Controlling → Profit Center Accounting → Master Data → Profit Center Group → Create.

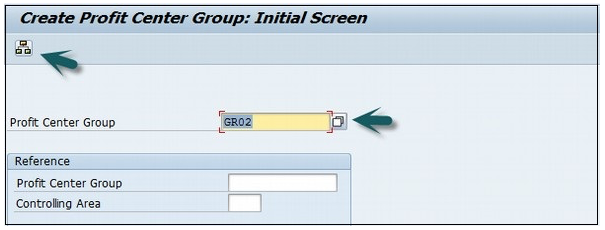

Enter the Controlling Area in which the Profit Center is to be created.

Enter the Unique Profit Center Group Id as shown below and press Enter.

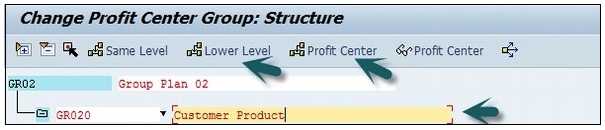

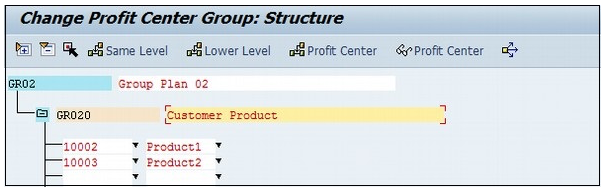

Enter the short description for the profit center group and click the Save icon at the top.

If you want to create/change the structure of a standard hierarchy, it can be done at two places −

Use the T-code KCH1 or go to Accounting → Controlling → Profit Center Accounting → Master Data → Standard Hierarchy → Create.

In the next screen, enter the Controlling Area for which you want to create a Standard hierarchy.

Enter the Profit Center Group and click Hierarchy at the top and enter the sub-nodes of the Profit Center Standard Hierarchy.

Click the Lower level button to create a hierarchy.

Click the Profit center to assign a Profit Center group.

Click the Save button at the top and you will get a confirmation message.

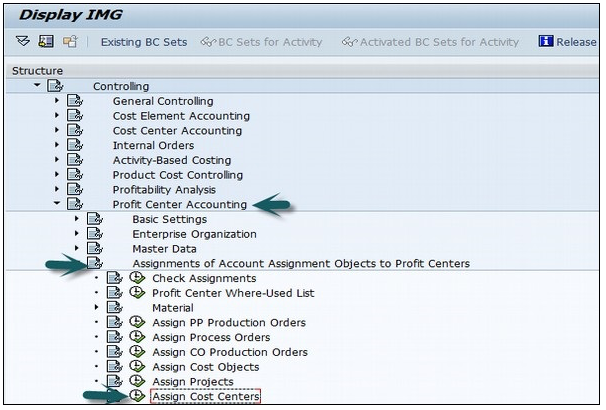

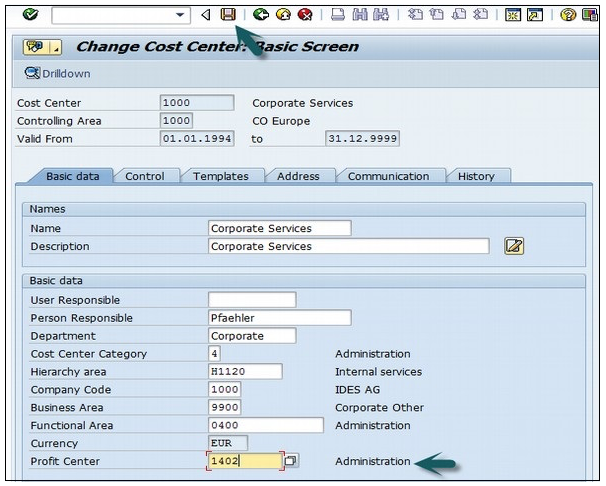

Go to SPRO → SAP Reference IMG → Controlling → Profit Center Accounting → Assignments of Account Assignment objects to Profit Center → Assign Cost Centers → Execute.

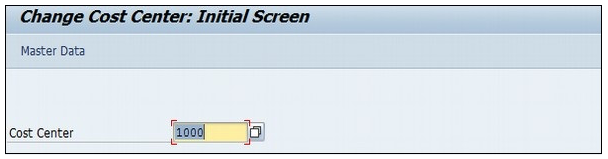

Enter the Cost center to be assigned to the Profit center.

In the next screen, enter the profit center to which the cost center is assigned and click the Save icon at the top.

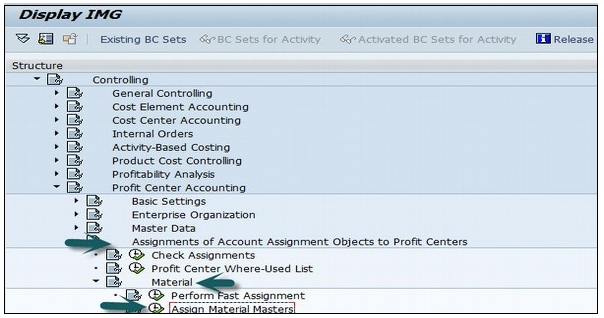

Go to SPRO → SAP Reference IMG → Controlling → Profit Center Accounting → Assignments of Account Assignment objects to Profit Center → Material → Assign Material Masters → Execute.

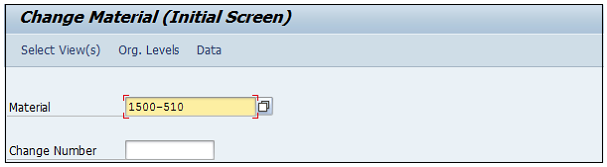

A new window will open. Enter the material Id for which the profit center is to be assigned and press Enter.

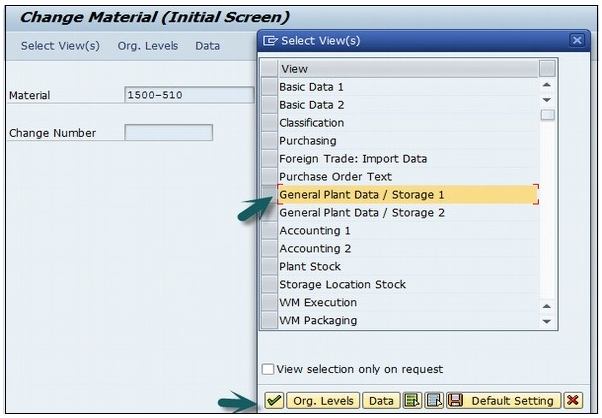

Select the view of the material master.

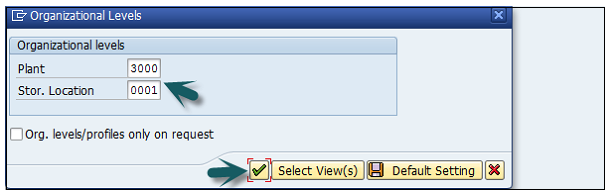

In the next window, enter the following details −

In the next window, enter the Profit Center and click the Save icon at the top.

| Important Tables in SAP CO | ||

|---|---|---|

| AUSP | Characteristic Values | MANDT / OBJEK / ATINN / ATZHL / MAFID / KLART / ADZHL |

| CO-KBAS | Overhead Cost Controlling | |

| A132 | Price per Cost Center | MANDT / KAPPL / KSCHL / KOKRS / VERSN / RESRC / KOSTL / DATBI |

| A136 | Price per Controlling Area | MANDT / KAPPL / KSCHL / KOKRS / VERSN / RESRC / DATBI |

| A137 | Price per Country / Region | MANDT / KAPPL / KSCHL / KOKRS / VERSN / RESRC / LAND1 / REGIO / DATBI |

| COSC | CO Objects: Assignment of Original Costing Sheets | MANDT / OBJNR / SCTYP / VERSN / GJAHR |

| CSSK | Cost Center / Cost Element | MANDT / VERSN / KOKRS / GJAHR / KOSTL / KSTAR |

| CSSL | Cost Center / Activity Type | MANDT / KOKRS / KOSTL / LSTAR / GJAHR |

| KAPS | CO Period Locks | MANDT / KOKRS / GJAHR / VERSN / VRGNG / PERBL |

| COKBASCORE | Overhead Cost Controlling: General Services | |

| CSKA | Cost Elements (Data Dependent on Chart of Accounts) | MANDT / KTOPL / KSTAR |

| CSKB | Cost Elements (Data Dependent on Controlling Area) | MANDT / KOKRS / KSTAR / DATBI |

| CSKS | Cost Center Master Data | MANDT / KOKRS / KOSTL / DATBI |

| CSLA | Activity Master | MANDT / KOKRS / LSTAR / DATBI |

| CO-OM (KACC) | Overhead Cost Controlling | |

| COBK | CO Object: Document Header | MANDT / KOKRS / BELNR |

| COEJ | CO Object: Line Items (by Fiscal Year) | MANDT / KOKRS / BELNR / BUZEI / PERBL |

| COEJL | CO Object: Line Items for Activity Types (by Fiscal Yr) | MANDT / KOKRS / BELNR / BUZEI / PERBL |

| COEJR | CO Object: Line Items for SKF (by Fiscal Year) | MANDT / KOKRS / BELNR / BUZEI / PERBL |

| COEJT | CO Object: Line Items for Prices (by Fiscal Year) | MANDT / KOKRS / BELNR / BUZEI / PERBL |

| COEP | CO Object: Line Items (by Period) | MANDT / KOKRS / BELNR / BUZEI |

| COEPL | CO Object: Line Items for Activity Types (by Period) | MANDT / KOKRS / BELNR / BUZEI |

| COEPR | CO Object: Line Items for SKF (by Period) | MANDT / KOKRS / BELNR / BUZEI |

| COEPT | CO Object: Line Items for Prices (by Period) | MANDT / KOKRS / BELNR / BUZEI |

| COKA | CO Object: Control Data for Cost Elements | MANDT / OBJNR / GJAHR / KSTAR / HRKFT |

| COKL | CO Object: Control Data for Activity Types | MANDT / LEDNR / OBJNR / GJAHR / VERSN |

| COKP | CO Object: Control Data for Primary Planning | MANDT / LEDNR / OBJNR / GJAHR / WRTTP / VERSN / KSTAR / HRKFT / VRGNG / VBUND / PARGB / BEKNZ / TWAER |

| COKR | CO Object: Control Data for Statistical Key Figures | MANDT / LEDNR / OBJNR / GJAHR / WRTTP / VERSN / STAGR / HRKFT / VRGNG |

| COKS | CO Object: Control Data for Secondary Planning | MANDT / LEDNR / OBJNR / GJAHR / WRTTP / VERSN / KSTAR / HRKFT / VRGNG / PAROB / USPOB / BEKNZ / TWAER |

| CO-OM-CEL (KKAL) | Cost Element Accounting (Reconciliation Ledger) | |

| COFI01 | Object Table for Reconciliation Ledger COFIT | MANDT / OBJNR |

| COFI02 | Transaction Dependent Fields for Reconciliation Ledger | MANDT / OBJNR |

| COFIP | Single Plan Items for Reconciliation Ledger | RCLNT / GL_SIRID |

| COFIS | Actual Line Items for Reconciliation Ledger | RCLNT / GL_SIRID |

| CO-OM-CCA | Cost Center Accounting (Cost Accounting Planning) | |

| A138 | Price per Company Code | MANDT / KAPPL / KSCHL / KOKRS / VERSN / RESRC / BUKRS / GSBER / DATBI |

| A139 | Price per Profit Center | MANDT / KAPPL / KSCHL / KOKRS / VERSN / RESRC / PRCTR / DATBI |

| CO-OMOPA(KABR) | Overhead Orders: Application Development R/3 Cost Accounting Settlement | |

| AUAA | Settlement Document: Receiver Segment | MANDT / BELNR / LFDNR |

| AUAB | Settlement Document: Distribution Rules | MANDT / BELNR / BUREG / LFDNR |

| AUAI | Settlement Rules per Depreciation Area | MANDT / BELNR / LFDNR / AFABE |

| AUAK | Document Header for Settlement | MANDT / BELNR |

| AUAO | Document Segment: CO Objects to be Settled | MANDT / BELNR / LFDNR |

| AUAV | Document Segment: Transactions | MANDT / BELNR / LFDNR |

| COBRA | Settlement Rule for Order Settlement | MANDT / OBJNR |

| COBRB | Distribution Rules Settlement Rule Order Settlement | MANDT / OBJNR / BUREG / LFDNR |

| CO-OM-OPA (KAUF) | Overhead Orders: Cost Accounting Orders | |

| AUFK | Order Master Data | MANDT / AUFNR |

| AUFLAY0 | Entity Table: Order Layouts | MANDT / LAYOUT |

| EC-PCA (KE1) | Profit Center Accounting | |

| CEPC | Profit Center Master Data Table | MANDT / PRCTR / DATBI / KOKRS |

| CEPCT | Texts for Profit Center Master Data | MANDT / SPRAS / PRCTR / DATBI / KOKRS |

| CEPC_BUKRS | Assignment of Profit Center to a Company Code | MANDT / KOKRS / PRCTR / BUKRS |

| GLPCA | EC-PCA: Actual Line Items | RCLNT / GL_SIRID |

| GLPCC | EC-PCA: Transaction Attributes | MANDT / OBJNR |

| GLPCO | EC-PCA: Object Table for Account Assignment Element | MANDT / OBJNR |

| GLPCP | EC-PCA: Plan Line Items | RCLNT / GL_SIRID |

| EC-PCA BS (KE1C) | PCA Basic Settings: Customizing for Profit Center Accounting | |

| A141 | Dependent on Material and Receiver Profit Center | MANDT / KAPPL / KSCHL / KOKRS / WERKS / MATNR / PPRCTR / DATBI |

| A142 | Dependent on Material | MANDT / KAPPL / KSCHL / WERKS / MATNR / DATBI |

| A143 | Dependent on Material Group | MANDT / KAPPL / KSCHL / WERKS / MATKL / DATBI |

SAP CO Product Costing module is used to find the value of internal cost of products.

It is also used for profitability and management accounting for production.

While configuring Product Costing, it involves two areas for setting −

The basics of Product Costing is Cost Center Planning.

The goal of cost center planning is to plan total dollars and quantities in each Cost Center in a Plant.

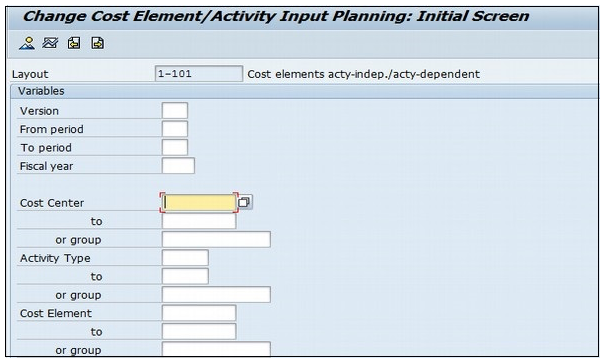

Use the T-code KP06 and enter the controlling area.

Cost Center dollars are planned by activity Type and cost element. You can also enter the variable and fixed dollar amounts.

You can plan all costs in production cost centers where they will end up through allocations, or you can plan costs where they are incurred and use plan assessments and distributions to allocate.

SAP CO Profitability Analysis is used to analyze the market segments classified as products, customers, sales area, business area, etc.

SAP CO Profitability Analysis (CO-PA) is used for the evaluation of Market segments which is classified according to products, customers, and orders −

There are two types of Profitability Analysis are supported −

Costing-based Profitability Analysis − It is used to group the costs and revenues as per the value fields. It is used to ensure that you access at all times to a complete, short-term profitability report.

Account-based Profitability Analysis − It is used to provide you with a profitability report that is permanently reconciled with financial accounting. It is mainly used for getting information related to sales, marketing, product management and corporate planning departments to support internal accounting and decision-making.

The key components in SAP CO-PA are as follows −

Actual Posting − It allows you to transfer sales orders and billing documents from the Sales and Distribution application component to CO-PA in real time. You can also transfer costs from cost centers, orders and projects, as well as costs and revenues from direct postings or settle costs from CO to profitability segment.

Information System − It allows you to analyze existing data from a profitability standpoint using drilldown function in the reporting tool. It allows you to navigate through a multidimensional data cube using different functions like drilldown or switching hierarchies. The system displays data in either value fields or accounts, depending on the currently active type of Profitability Analysis and the type to which the report structure is assigned.

Planning − This allows you to create a sales and profit plan. Whereas both types of Profitability Analysis can receive actual data in parallel, there is no common source of planning data. Consequently, you always plan either in accounts (account-based CO-PA) or in value fields (costing-based CO-PA). The manual planning function allows you to define planning screens for your organization. With this you can display reference data in planning, calculate formulas, create forecasts, and more. You can perform planning at any level of detail.

You can plan at a higher level, and have this data distributed top-down automatically. In automatic planning, you can copy and revaluate actual or planning data for a large number of profitability segments at once.

SAP CO Planning Method allows you to plan the profitability segments as mentioned in the Planning packages.

To execute a planning method, you need to define it in a parameter set. Each planning method is executed via parameter set. To create a parameter set, you need to first define the Planning level. For parameter set to execute, there should be at least one planning package exists at that level.

There are two different types of planning methods and they differ in the way they allow you to enter and edit planning data for the profitability segments.

Manual planning methods allows you to enter planning data and display planning data in the profitability segments specified in the planning package are listed individually for editing or display.

In parameter set, you mention how the profitability segments are to be listed. When planning method is executed, processing of parameter set occurs and you can directly check the results of your processing.

With automatic planning methods like copy, top-down distribution and delete, all profitability segments that are specified in the planning package are processed.

You need to mention in the parameter set like- how these segments are to be processed, when you execute the method, the system automatically processes the segments without any need of manual action.

Results of the processing can be checked using a report in the information system or by manual planning method display planning data.

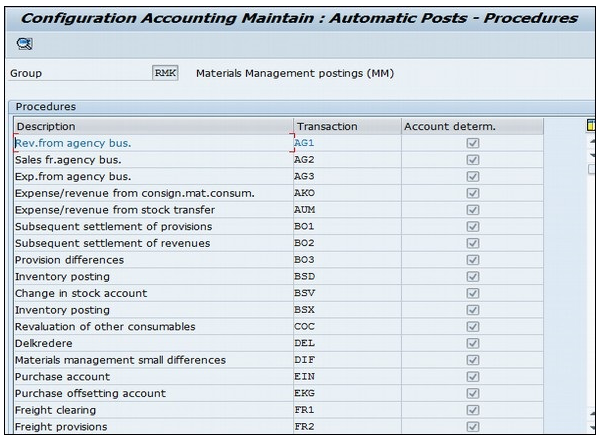

For SAP FI-MM, use the T-code OBYC

Whenever there is a delivery created with reference to a sales order, goods movement takes place in the system.

In case of standard sales order, you create an outbound goods delivery to the customer.

Here movement 601 takes place. This movement is configured in MM and movement of goods hit some G/L account in FI.

Every such movement of goods hits General Ledger account in FI.

The accounts posting in FI is done with reference to the billing documents like credit and debit note, invoice etc. created in SD and hence this is link between SD and FI.

Tax determination: In case of a tax determination, there is a direct link between SD and MM.

Material movements in MM is done with respect to a Movement Type.

SAP allows us to use different G/L accounts for the various movements for the same material by linking this movement type to a transaction key and hence we can set G/L accounts as per movement type.