| Module | Module Name | Links | Links | Blake's Links |

| PM | Plant Mantenance | tutorials point | Blake | |

| MM | Material Management | tutorials point Overview | Guru99 | Blake: 1-10 | 11-20 | 21-25 |

| SD | Sales and Distribution | tutorials point Tutorial | Guru99 | Blake |

| PP | Production Planning | tutorials point Tutorial | Guru99 | Blake | 1-7 |

| External Links | ||||

| NewLanguage.html | FICO Module: Blake's 1-28 29-56 57-66 67-83 : Tutorials Point | |||

| Download Info | ABAP Module: Blake's 1-18 19-36 37-52 : Tutorials Point | |||

| 1 | Home | FICO_Doc Tutorials Point | 29 | Block a Customer | FICO_Doc Tutorials Point | 57 | Month End Closing | FICO_Doc Tutorials Point | ||

| 2 | Overview | FICO_Doc Tutorials Point | 30 | Delete a Customer | FICO_Doc Tutorials Point | 58 | Dunning | FICO_Doc Tutorials Point | ||

| 3 | Submodules | FICO_Doc Tutorials Point | 31 | Customer Account Group | FICO_Doc Tutorials Point | 59 | Exchange Rates | FICO_Doc Tutorials Point | ||

| 4 | Company Basics | FICO_Doc Tutorials Point | 32 | One-Time Customer Master | FICO_Doc Tutorials Point | 60 | Tables in Module | FICO_Doc Tutorials Point | ||

| 5 | Define Business Area | FICO_Doc Tutorials Point | 33 | Post a Sales Invoice | FICO_Doc Tutorials Point | 61 | AR Invoice Processes | FICO_Doc Tutorials Point | ||

| 6 | Define Functional Area | FICO_Doc Tutorials Point | 34 | Document Reversal | FICO_Doc Tutorials Point | 62 | AR Account Analysis | FICO_Doc Tutorials Point | ||

| 7 | Define Credit Control | FICO_Doc Tutorials Point | 35 | Sales Returns | FICO_Doc Tutorials Point | 63 | AR Reporting | FICO_Doc Tutorials Point | ||

| 8 | General Ledger | FICO_Doc Tutorials Point | 36 | Post Incoming Payment | FICO_Doc Tutorials Point | 64 | AA Overview | FICO_Doc Tutorials Point | ||

| 9 | COA Group (Chart of Accts) | FICO_Doc Tutorials Point | 37 | Foreign Currency Invoice | FICO_Doc Tutorials Point | 65 | AA Asset Explorer | FICO_Doc Tutorials Point | ||

| 10 | Retained Earnings Account | FICO_Doc Tutorials Point | 38 | Incoming Partial Payments | FICO_Doc Tutorials Point | 66 | Cash Management | FICO_Doc Tutorials Point | ||

| 11 | G/L Account | FICO_Doc Tutorials Point | 39 | Reset AR Cleared Items | FICO_Doc Tutorials Point | |||||

| 12 | Block G/L Account | FICO_Doc Tutorials Point | 40 | Credit Control | FICO_Doc Tutorials Point | 67 | CO Overview | FICO_Doc Tutorials Point | ||

| 13 | Deleting G/L Accounts | FICO_Doc Tutorials Point | 41 | Accounts Payable | FICO_Doc Tutorials Point | 68 | CO Submodules | FICO_Doc Tutorials Point | ||

| 14 | Financial Statement Version | FICO_Doc Tutorials Point | 42 | Create a Vendor | FICO_Doc Tutorials Point | 69 | CO Cost Center | FICO_Doc Tutorials Point | ||

| 15 | Journal Entry Posting | FICO_Doc Tutorials Point | 43 | Create Vendor Account Group | FICO_Doc Tutorials Point | 70 | CO Create Cost Center | FICO_Doc Tutorials Point | ||

| 16 | Fiscal Year Variant | FICO_Doc Tutorials Point | 44 | Display Changed Fields | FICO_Doc Tutorials Point | 71 | CO Post to a Cost Center | FICO_Doc Tutorials Point | ||

| 17 | Posting Period Variant | FICO_Doc Tutorials Point | 45 | Block a Vendor | FICO_Doc Tutorials Point | 72 | CO Internal Orders | FICO_Doc Tutorials Point | ||

| 18 | Field Status Variant | FICO_Doc Tutorials Point | 46 | Delete a Vendor | FICO_Doc Tutorials Point | 73 | CO Settlement of IO | FICO_Doc Tutorials Point | ||

| 19 | Field Status Group | FICO_Doc Tutorials Point | 47 | One-Time Vendor | FICO_Doc Tutorials Point | 74 | CO Profit Center | FICO_Doc Tutorials Point | ||

| 20 | Define Posting Keys | FICO_Doc Tutorials Point | 48 | Post Purchase Invoice | FICO_Doc Tutorials Point | 75 | CO Posting to Profit Center | FICO_Doc Tutorials Point | ||

| 21 | Define Document Type | FICO_Doc Tutorials Point | 49 | Purchase Returns | FICO_Doc Tutorials Point | 76 | CO Profit Center Standard Heirarchy | FICO_Doc Tutorials Point | ||

| 22 | Document Number Ranges | FICO_Doc Tutorials Point | 50 | Post Outgoing Vendor Payment | FICO_Doc Tutorials Point | 77 | CO Assigning Cost to Profit Centers | FICO_Doc Tutorials Point | ||

| 23 | Post with Reference | FICO_Doc Tutorials Point | 51 | Foreign Currency Invoice | FICO_Doc Tutorials Point | 78 | CO Assigning Materials to Profit Centers | FICO_Doc Tutorials Point | ||

| 24 | Hold a G/L Document Posting | FICO_Doc Tutorials Point | 52 | Withholding Tax in vendor invoice | FICO_Doc Tutorials Point | 79 | CO Tables in Module | FICO_Doc Tutorials Point | ||

| 25 | Park a G/L Document Posting | FICO_Doc Tutorials Point | 53 | Outgoing Partial Payments | FICO_Doc Tutorials Point | 80 | CO Product Costing | FICO_Doc Tutorials Point | ||

| 26 | G/L Reporting | FICO_Doc Tutorials Point | 54 | Reset AP Cleared Items | FICO_Doc Tutorials Point | 81 | CO Profitability Analysis | FICO_Doc Tutorials Point | ||

| 27 | Accounts Receivable | FICO_Doc Tutorials Point | 55 | Automatic Payment Run | FICO_Doc Tutorials Point | 82 | CO Planning Methods | FICO_Doc Tutorials Point | ||

| 28 | Customer Master Data | FICO_Doc Tutorials Point | 56 | Posting Rounding Differences | FICO_Doc Tutorials Point | 83 | FI - Integration | FICO_Doc Tutorials Point |

In SAP FI, month-end closing involves activities in posting a closing period. You can carry out the following activities as a part of month-end closing −

Open and close posting periods.

You close one or more posting periods in the past for posting, and permit posting to be made to one or more current or future posting periods.

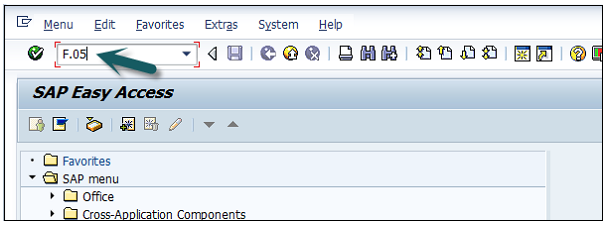

Use the T-code F.05 or FAGL_FC_VAL for new G/L accounts.

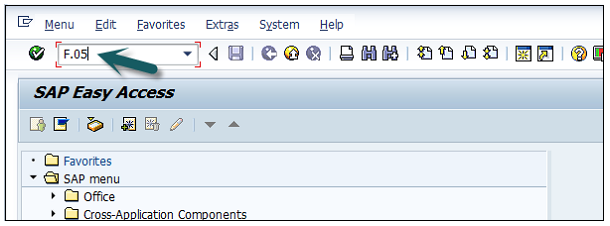

It will open a new window wherein you need to enter the following details −

You can filter out Valuation activity by entering the appropriate parameters in the Tab Screens.

Click the Execute button

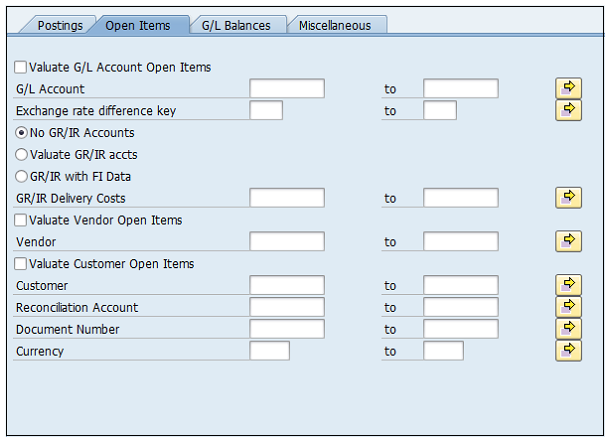

![]() . It will open a list of all G/L accounts selected for foreign currency valuation.

. It will open a list of all G/L accounts selected for foreign currency valuation.

In SAP FI, if a customer misses the payment for the outstanding invoice by payment due date, you can generate a dunning letter using SAP FI and send it to the customer address to remind him of the outstanding payment.

The dunning system enables to trace liable customers who have not paid their open invoices within a given time span. It enables you to handle the process from, for example, sending a reminder to customers of their outstanding payments through referring such customers to collections agencies.

The dunning system covers the following documents.

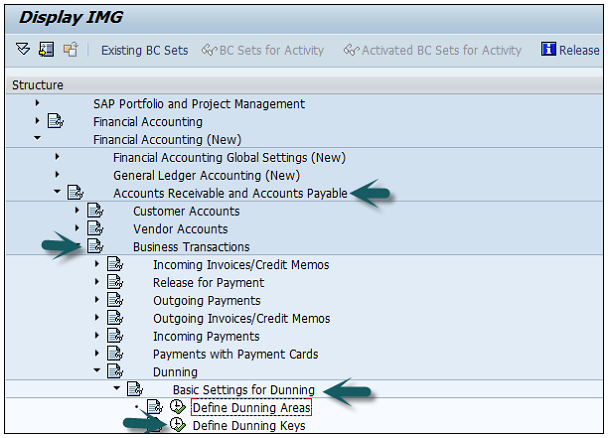

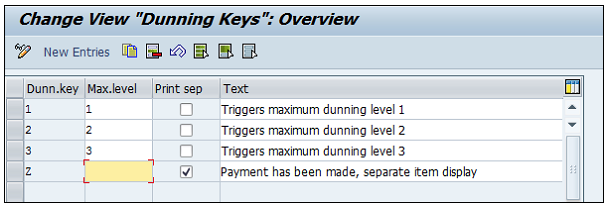

Go to SPRO → SAP Reference IMG → Financial Accounting (New) → AR and AP → Business Transactions → Dunning → Basic Setting for Dunning → Define Dunning Keys → Execute.

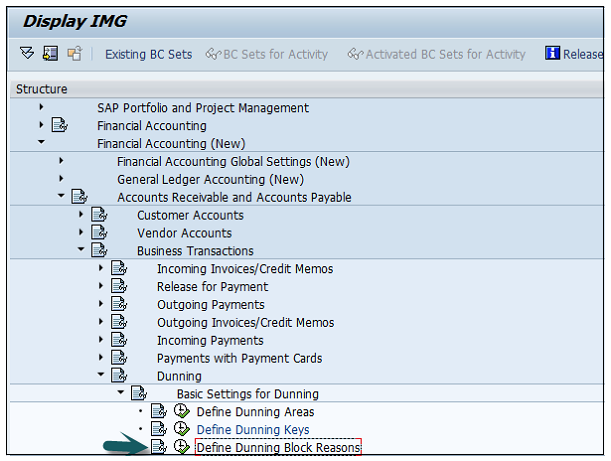

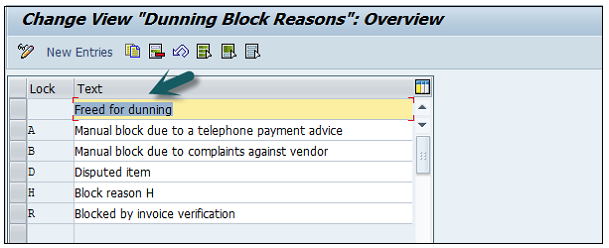

Here you define the reason for dunning block reason under a key.

It can be defined for an item or for a customer master.

Blocked item or customer account are not considered for dunning reason.

You define exchange rates in the system for the following purposes −

Posting and Clearing − To translate amounts posted or cleared in foreign currency, or to check a manually entered exchange rate during posting or clearing.

Exchange Rate Differences − To determine gains or losses from exchange rate differences.

Foreign Currency Valuation − To valuate open items in foreign currency and foreign currency balance sheet accounts as part of the closing operations.

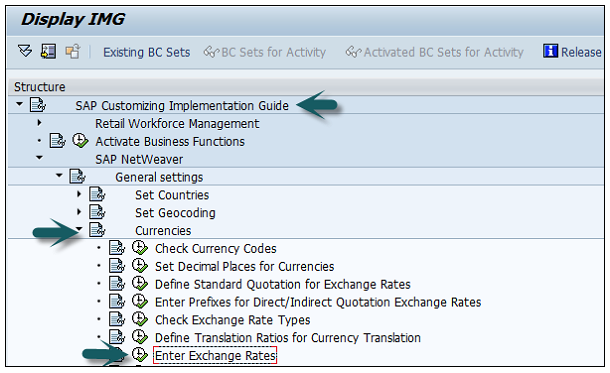

Go to SPRO → SAP Reference IMG → SAP Netweaver → General Settings → Currencies → Enter Exchange Rates → Execute.

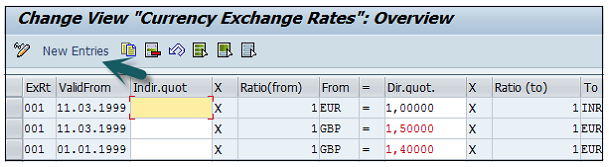

Exchange rates can be entered as direct or indirect quotations. In direct quotation, we give multiple of base currency to foreign currency.

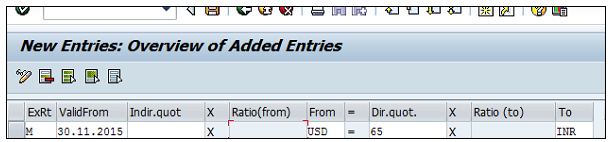

Example − 1 USD = 65 × 1 INR

For indirect quotation, it will be 1/65 USD = 1 INR.

In the next window, enter the following details −

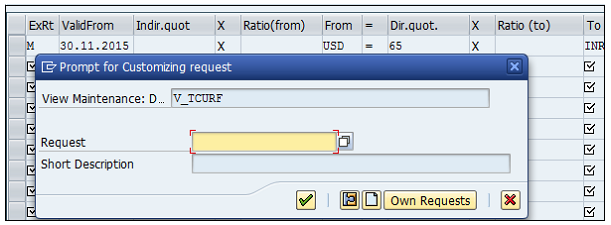

After entering the details, click the Save button.

Enter the request number and click the tick mark.

| FBAS | Financial Accounting “Basis” | |

| BKPF | Accounting Document Header | MANDT / BUKRS / BELNR / GJAHR |

| BSEG | Accounting Document Segment | MANDT / BUKRS / BELNR / GJAHR / BUZEI |

| BSIP | Index for Vendor Validation of Double Documents | MANDT / BUKRS / LIFNR / WAERS / BLDAT / XBLNR / WRBTR / BELNR / GJAHR / BUZEI |

| BVOR | Inter Company Posting Procedure | MANDT / BVORG / BUKRS / GJAHR / BELNR |

| EBKPF | Accounting Document Header (docs from External Systems) | MANDT / GLSBK / BELNR / GJHAR / GLEBK |

| FRUN | Run Date of a Program | MANDT / PRGID |

| KLPA | Customer / Vendor Linking | MANDT / NKULI / NBUKR / NKOAR / PNTYP / VKULI / VBUKR / VKOAR |

| KNB4 | Customer Payment History | MANDT / KUNNR / BUKRS |

| KNB5 | Customer Master Dunning Data | MANDT / KUNNR / BUKRS / MABER |

| KNBK | Customer Master Bank Details | MANDT / KUNNR / BANKS / BANKL / BANKN |

| KNC1 | Customer Master Transaction Figures | MANDT / KUNNR / BUKRS / GJHAR |

| KNC3 | Customer Master Special GL Transactions Figures | MANDT / KUNNR / BUKRS / GJAHR / SHBKZ |

| LFB5 | Vendor Master Dunning Data | MANDT / LIFNR / BUKRS / MABER |

| LFBK | Vendor Master Bank Details | MANDT / LIFNR / BANKS / BANKL / BANKN |

| LFC1 | Vendor Master Transaction Figures | MANDT / LIFNR / BUKRS / GJHAR |

| LFC3 | Vendor Master Special GL Transactions Figures | MANDT / LIFNR / BUKRS / GJHAR / SHBKZ |

| VBKPF | Document Header for Document Parking | MANDT / AUSBK / BUKRS / BELNR / GJHAR |

| FBASCORE | Financial Accounting General Services “Basis” | |

| KNB1 | Customer Master (Company Code) | MANDT / KUNNR / BUKRS |

| LFA1 | Vendor Master (General Section) | MANDT / LIFNR |

| LFB1 | Vendor Master (company Code Section) | MANDT / LIFNR / BUKRS |

| SKA1 | G/L Account Master (Chart of Accounts) | MANDT / KTOPL / SAKNR |

| SKAT | G/L Account Master (Chart of Accounts – Description) | MANDT / SPRAS / KTOPL / SAKNR |

| MAHNS | Accounts Blocked by Dunning Selection | MANDT / KOART / BUKRS / KONKO / MABER |

| MHNK | Dunning Data (Account Entries) | MANDT / LAUFD / LAUFI / KOART / BUKRS / KUNNR / LIFNR / CPDKY / SKNRZE / SMABER / SMAHSK / BUSAB |

| FI-GL-GL (FBS) | General Ledger Accounting: Basic Functions- G/L Accounts | |

| SKAS | G/L Account Master (Chart of Accounts – Key Word list) | MANDT / SPRAS / KTOPL / SAKNR / SCHLW |

| SKB1 | G/L Account Master (Company Code) | MANDT / BUKRS / SAKNR |

| FI-GL-GL (FBSC) | General Ledger Accounting: Basic Functions - R/3 Customizing for G/L Accounts | |

| FIGLREP | Settings for G/L Posting Reports | MANDT |

| TSAKR | Create G/L account with reference | MANDT / BUKRS / SAKNR |

| FI-GL-GL (FFE) | General Ledger Accounting: Basic Functions - Fast Data Entry | |

| KOMU | Account Assignment Templates for G/L Account items | MANDT / KMNAM / KMZEI |

| FI-AR-AR (FBD) | Accounts Receivable: Basic Functions - Customers | |

| KNKA | Customer Master Credit Management : Central Data | MANDT / KUNNR |

| KNKK | Customer Master Credit Management : Control Area Data | MANDT / KUNNR / KKBER |

| KNKKF1 | Credit Management : FI Status data | MANDT / LOGSYS / KUNNR / KKBER / REGUL |

| RFRR | Accounting Data – A/R and A/P Information System | MANDT / RELID / SRTFD / SRTF2 |

| FI-BL-PT (BFIBL_CHECK_D) | Bank Accounting: Payment Transactions – General Sections | |

| PAYR | Payment Medium File | MANDT / ZBUKR / HBKID / HKTID / RZAWE / CHECT |

| PCEC | Pre-numbered Check | MANDT / ZBUKR / HBKID / HKTID / STAPL |

| FI-BL-PT-AP(FMZA) | Bank Accounting: Payment Transactions – Automatic Payments | |

| F111G | Global Settings for Payment Program for Payment Requests | MANDT |

| FDZA | Cash Management Line Items in Payment Requests | MANDT / KEYNO |

| PAYRQ | Payment Requests | MANDT / KEYNO |

| FI-AA-AA (AA) | Asset Accounting: Basic Functions – Master Data | |

| ANKA | Asset Classes: General Data | MANDT / ANLKL |

| ANKP | Asset Classes: Fld Cont Dpndnt on Chart of Depreciation | MANDT / ANLKL / AFAPL |

| ANKT | Asset Classes: Description | MANDT / SPRAS / ANLKL |

| ANKV | Asset Classes: Insurance Types | MANDT / ANLKL / VRSLFD |

| ANLA | Asset Master Record Segment | MANDT / BUKRS / ANLN1 / ANLN2 |

| ANLB | Depreciation Terms | MANDT / BUKRS / ANLN1 / ANLN2 / AFABE / BDATU |

| ANLT | Asset Texts | MANDT / SPRAS / BUKRS / ANLN1 / ANLN2 |

| ANLU | Asset Master Record User Fields | .INCLUDE / MANDT / BUKRS / ANLN1 / ANLN2 |

| ANLW | Insurable Values (Year Dependent) | MANDT / BUKRS / ANLN1 / ANLN2 / VRSLFD / GJAHR |

| ANLX | Asset Master Record Segment | MANDT / BUKRS / ANLN1 / ANLN2 |

| ANLZ | Time Dependent Asset Allocations | MANDT / BUKRS / ANLN1 / ANLN2 / BDATU |

| FI-AA-AA (AA2) | Asset Accounting: Basic Functions – Master Data 2.0 | |

| ANAR | Asset Types | MANDT / ANLAR |

| ANAT | Asset Type Text | MANDT / SPRAS / ANLAR |

| FI-AA-AA (AB) | Asset Accounting: Basic Functions – Asset Accounting | |

| ANEK | Document Header Asset Posting | MANDT / BUKRS / ANLN1 / ANLN2 / GJAHR / LNRAN |

| ANEP | Asset Line Items | MANDT / BUKRS / ANLN1 / ANLN2 / GJAHR / LNRAN / AFABE |

| ANEV | Asset Downpymt Settlement | MANDT / BUKRS / ANLN1 / ANLN2 / GJAHR / LNRANS |

| ANKB | Asset Class: Depreciation Area | MANDT / ANLKL / AFAPL / AFABE / BDATU |

| ANLC | Asset value Fields | MANDT / BUKRS / ANLN1 / ANLN2 / GJAHR / AFABE |

| ANLH | Main Asset Number | MANDT / BUKRS / ANLN1 |

| ANLP | Asset Periodic Values | MANDT / BUKRS / GJAHR / PERAF / AFBNR / ANLN1 / ANLN2 / AFABER |

| FI-SL-VSR (GVAL) | Special Purpose Ledger: Validation, Substitution and Rules | |

| GB03 | Validation / Substitution User | VALUSER |

| GB92 | Substitutions | MANDT / SUBSTID |

| GB93 | Validation | MANDT / VALID |

Invoicing processes are used as selection parameters for mass activities for "Invoicing in Contract Accounts Receivable and Payable".

Number ranges for invoicing documents are defined dependent on the invoicing processes.

Invoicing processes are a differentiation characteristic for the activation of optional invoicing functions.

The individual process steps of "Invoicing in Contract Accounts Receivable and Payable" are explained below.

Invoice processes involve the following steps −

Data Selection − In data selection, the invoicing orders are selected for the invoicing process. You define the selection criteria for the data selection for the invoicing process.

Creation of Invoicing Units − The invoicing orders selected are grouped into invoicing units for each contract account. You can create several invoicing units for each contract account. For each invoicing unit, "Invoicing in Contract Accounts Receivable and Payable" creates one invoicing document. You define the criteria for creating the invoicing units for the invoicing process.

Processing of Billing Documents − The billing documents selected for an invoicing unit are included in the invoicing document. The billing document items are linked with the items of the invoicing document, and the derivations required for the posting in "Contract Accounts Receivable and Payable" (FI-CA) are performed.

Performance of Additional Functions − In addition to processing billing documents, in "Invoicing in Contract Accounts Receivable and Payable" , you can integrate further functions of FI-CA. For example, interest calculation, creation of dunning proposals, or the calculation of charges and discounts. You define which additional functions are performed for each invoicing process.

Account Maintenance − Using the account maintenance integrated in "Invoicing in Contract Accounts Receivable and Payable", you can perform clearing between the posting documents entered in Invoicing and the open items of the contract account posted before invoicing. You define the criteria for clearing in the clearing control.

Update − The invoicing document created for the invoicing unit and the posting documents are written to the database. The invoicing orders processed are deleted. As well as the invoicing unit, a correspondence container for invoice printing and an extraction order for the update to BW are created.

There are many types of reports that can be used for account analysis (A/R) −

T-code − FBL5N

Customer line item report will be generated based on the open items, cleared items, and all items. It has options available to see transactions based on type: i.e., special G/L, Noted items, Parked items and vendor items.

T-code − FD10N

This report will be generated as customer-wise / period-wise balances, including debit and credit amount separately. It will also display the balances related to special G/L under different form and gives the total.

Balances of open Sales Invoice, Debit note and Credit note is available under separate columns in the same report. Users have the facility to incorporate required fields by changing the report layout.

T-code − F.30

This report helps in analyzing customer open transactions company-wise, group-wise, Credit control, etc. Users can define open transactions criteria based on due date, payment history, currency analysis, overdue items etc.

SAP T-codes to be used for Account Analysis in SAP FI −

There are various reports that you can generate in Account Receivable.

Following are the common reports in SAP FI AR along with their T-codes used to generate the report −

Bill Holdings (Bill of Exchange Receivable List with ALV facility): S-ALR_87009987

Customer Balances in Local Currency: S_ALR_87012172

Customer Line Items: S_ALR_87012197

Due Dates Analysis for Open Items: S_ALR_87012168

List of Customer Open Items: S_ALR_87012173

Customer Evaluation with Open Item Sorted List: S_ALR_87012176

Customer Payment History: S_ALR_87012177

Customer Open Item Analysis (Overdue Items Balance): S_ALR_87012178

List of Customer Cleared Line Items: S_ALR_87012198

List of Down Payments open at key date: S_ALR_87012199

Debit & Credit Notes Register u2013 Monthly: S_ALR_87012287

Customer-wise Sales: S_ALR_87012186

In Financial Accounting, it serves as a subsidiary ledger to the General Ledger, providing detailed information on transactions involving fixed assets.

Integration with other components − As a result of the integration in the SAP system, Asset Accounting (FI-AA) transfers data directly to and from other SAP components.

It is possible to post from the Materials Management (MM) component directly to FI-AA. When an asset is purchased or produced in-house, you can directly post the invoice receipt or goods receipt, or the withdrawal from the warehouse, to assets in the "Asset Accounting" component.

At the same time, you can pass on depreciation and interest directly to the "Financial Accounting" (FI) and "Controlling" (CO) components. From the "Plant Maintenance" (PM) component, you can settle maintenance activities that require capitalization to assets.

The "Asset Accounting" component consists of the following parts −

Traditional asset accounting encompasses the entire lifetime of the asset from purchase order or the initial acquisition through its retirement. The system calculates, to a large extent automatically, the values for depreciation, interest, insurance and other purposes between these two points in time, and places this information at your disposal in varied from using the Information System. There is a report for depreciation forecasting and simulation of the development of asset values.

The system also offers special functions for leased assets, and assets under construction. The system enables you to manage values in parallel currencies using different types of valuation. These features simplify the process of preparing for the consolidation of multinational group concerns.

The "Plant Maintenance" (PM) component offers functions for the technical management of assets in the form of functional locations and as equipment. The "Treasury" (TR) component offers special functions for managing financial assets.

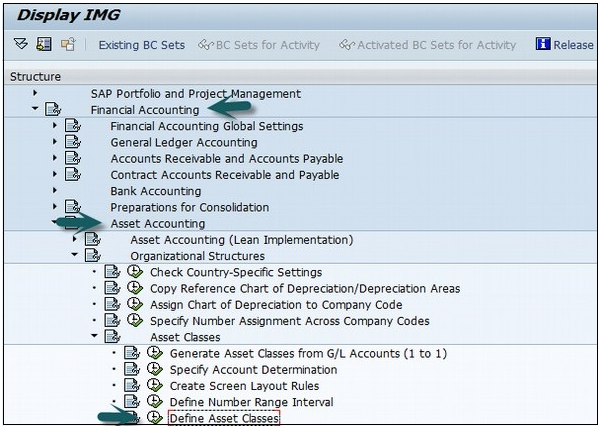

Use the T-code OAOA or go to SPRO → SAP Reference IMG → Financial Accounting → Asset Accounting → Organizational Structure → Asset Classes → Define Asset Classes → Execute.

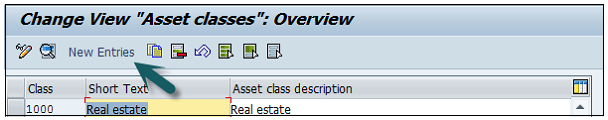

Click New Entries as shown in the following screenshot.

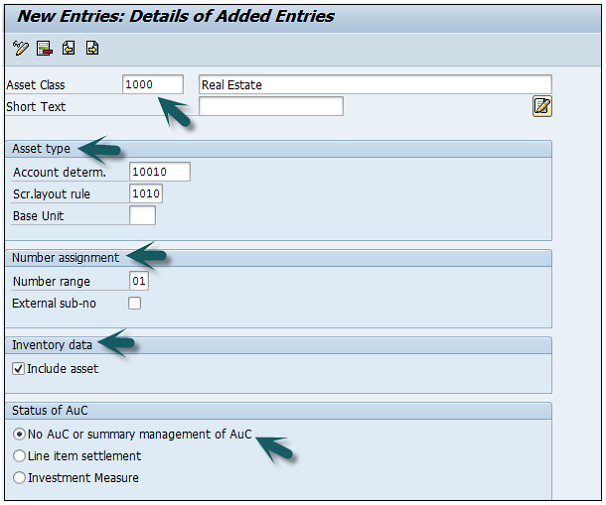

In the next screen, enter the following details −

You can also select Asset under construction (AuC).

Click the Save icon to configure the asset class.

This function shows all the values of a fixed asset, including APC values and depreciation, in various forms and summarization levels. Planned values are displayed as well as the values already posted. You use this function to display and analyze asset values.

Asset Explorer consists of the following components −

Header − This is the field where you enter the company code and asset number.

Overview tree − Using overview tree, you can navigate between different depreciation areas. Overview tree displays objects related to the asset.

Tab − This is where you analyze plan values and posted values using different parameters, and compare fiscal years and depreciation areas.

Note − The Asset Explorer uses ALV Grid Control for its table display. You can use it to specify the contents of the columns.

With the company code and main asset number, you can also enter the asset sub-number. If you enter an asterisk (*) in the sub number field, the Asset Explorer shows all transactions and depreciation of all sub numbers of the asset main number. Use “This graphic” is explained in the accompanying text and “This graphic” is explained in the accompanying text icons to navigate to different fiscal years.

Choose the pushbutton above the overview tree, or “this graphic” is explained in the accompanying text Display master data function, to reach the display transaction for asset master data.

To navigate between depreciation areas in the overview tree, select the depreciation area you want. Icons indicate the type of depreciation area. This graphic is explained in the accompanying text icon indicates a real depreciation area, and the “This graphic” is explained in the accompanying text icon indicates a derived depreciation area.

The system automatically searches for objects related to the asset, such as cost center, equipment, G/L account, WBS element, and displays them in an overview tree. From this overview tree, you can jump directly to the display transaction of the given master data.

There are additional options if the asset was created or posted from a purchase order. In that case, you can double click on the Purchase Orders folder to go to a report that displays all Materials Management documents that are linked to the asset.

When you enter an asterisk (*) for the sub-number in the Asset Explorer, the search for related objects is deactivated. On the Planned Values, Posted Values, and Comparisons tab pages, the system shows the total of all sub-numbers for all fields. On the Parameters tab page, the individual parameters are displayed only if they are the same for the main number and all sub-numbers. If they are not all the same (for example, the main asset and sub-numbers have different useful lives), then the field is shown with an asterisk (*).

The Transactions subscreen shows all transactions for all the sub-numbers. The display of planned/posted depreciation per period shows the total of all sub-numbers for each period. When you jump to other Asset Accounting reports, these are started without being limited to a sub-number. The report then displays all sub-numbers.

Display of the depreciation trace (RATRACE0N) − The trace always relates to a specific asset and it is not possible to add assets together. The report is started for the asset that has the lowest sub-number.

Display of asset master record (AS03) − It is started for the first existing asset.

The Cash Management field in SAP FI is used to manage cash flows and to ensure that you have sufficient liquidity to cover your payment obligations.

SAP FI Cash Management is a sub-component of Financial Supply Chain Management. It can be integrated with a range of other SAP components.

Example − The liquidity forecast – in a medium- to long-term liquidity trend – integrates expected incoming and outgoing payments in financial accounting, purchase, and sales.

SAP FI Cash Management Incomings area covers the following topics −

Compare payment advices, "Interest calculation "and "Returned vendor checks" are dealt with the Checks topic.

Cash concentration can be found in the Planning topic. Planning also deals with the "payment program", "payment requests", "bill of exchange presentation", "memo record "and "telephone list".

The tools topic covers the "distribution" to cash management systems.

The Information System topic deals among other things with the "Liquidity forecast."

Further topics include: Payment advice journal, Compare and check "and "Reconciliation with cash management.

In the Environment area, you will find functions for transferring market data to the SAP system. Market data can be transferred using the file interface, real-time data feed, or via a spreadsheet.

paragraph